Research with Minority Populations: An Opportunity for Brands in China

We exist in a society that is continuously globalizing and transforming. As our populations increase, and our cultures intertwine, the consumer world that surrounds us adapts and adjusts. Ethnic minorities across the globe are becoming a growing economic force with immense buying power. How do brands tap into this increased demand? Brands must recognize and understand the precise mechanisms and approaches involved to effectively appeal to these groups of consumers. Such research on ethnic minority populations is now an internationally emerging trend – an important advancement towards a better understanding of our richly diverse consumer world.

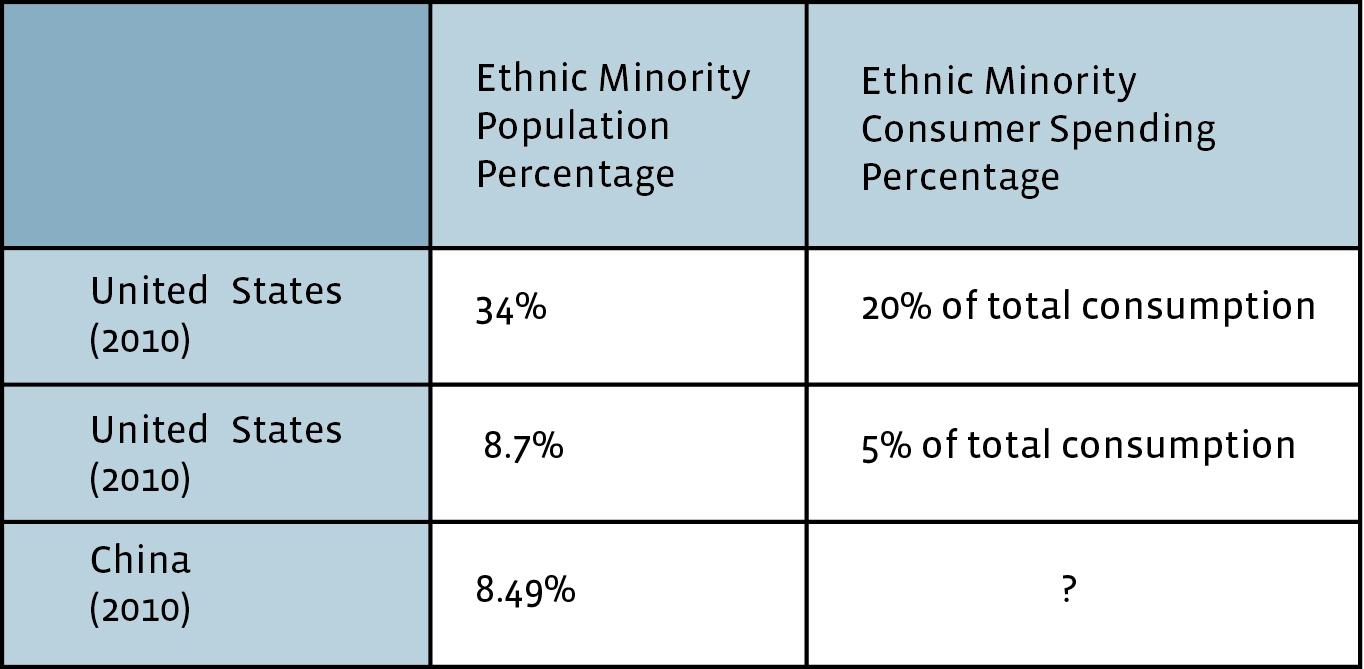

Recent statistics show that ethnic minorities have a very strong impact on consumer transactions on a global scale (see Table 1). How can brands cater to such diverse consumers? What roles do brands play in successfully incorporating distinct minority communities into the broader consumer society? Extensive research is the key to discovering the underlying components involved in marketing, branding, and advertising to appeal to the population as a whole – ethnic minority groups included.

Table 1 Ethnic Minority Population and Consumer Spending Worldwide

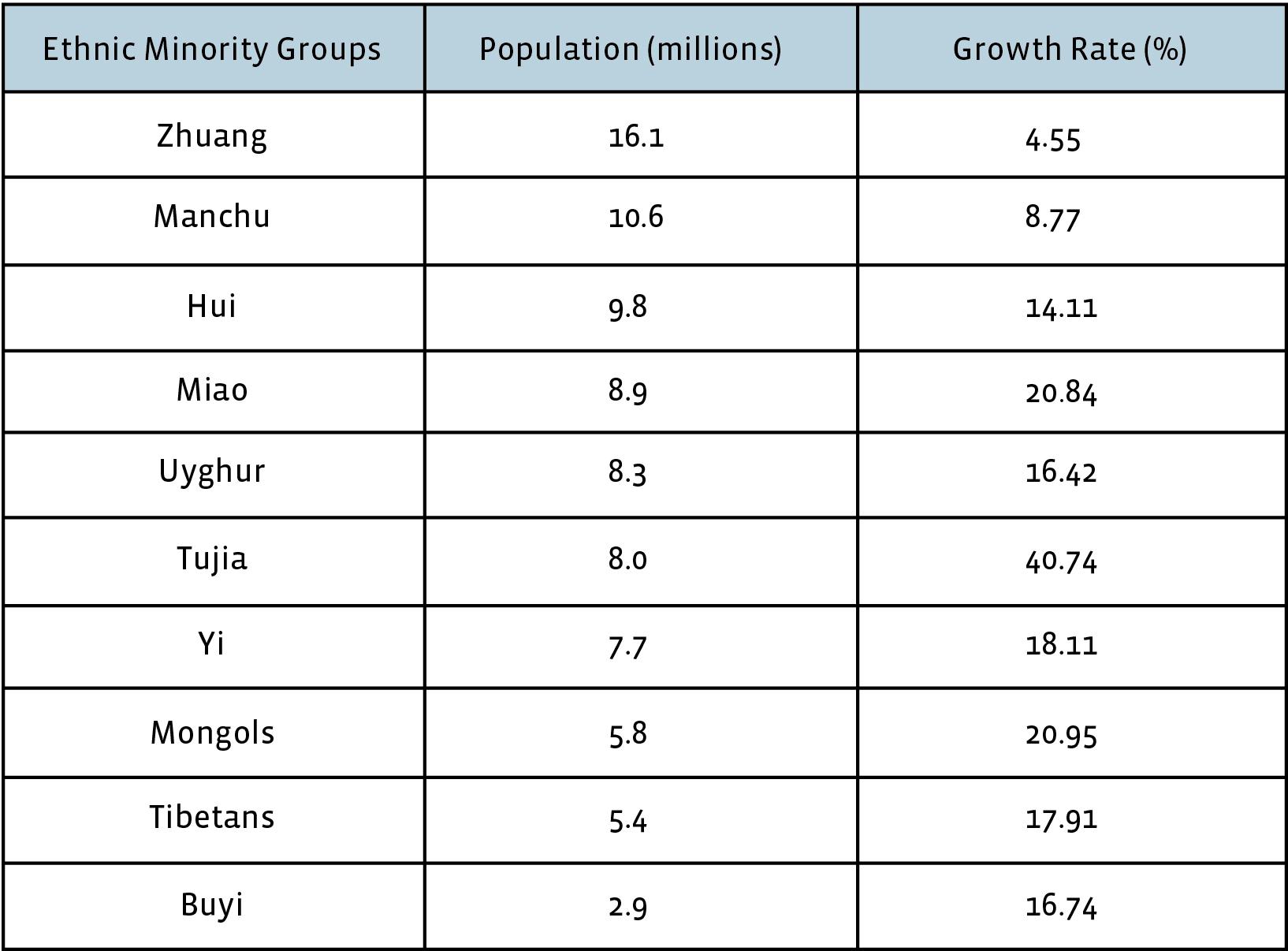

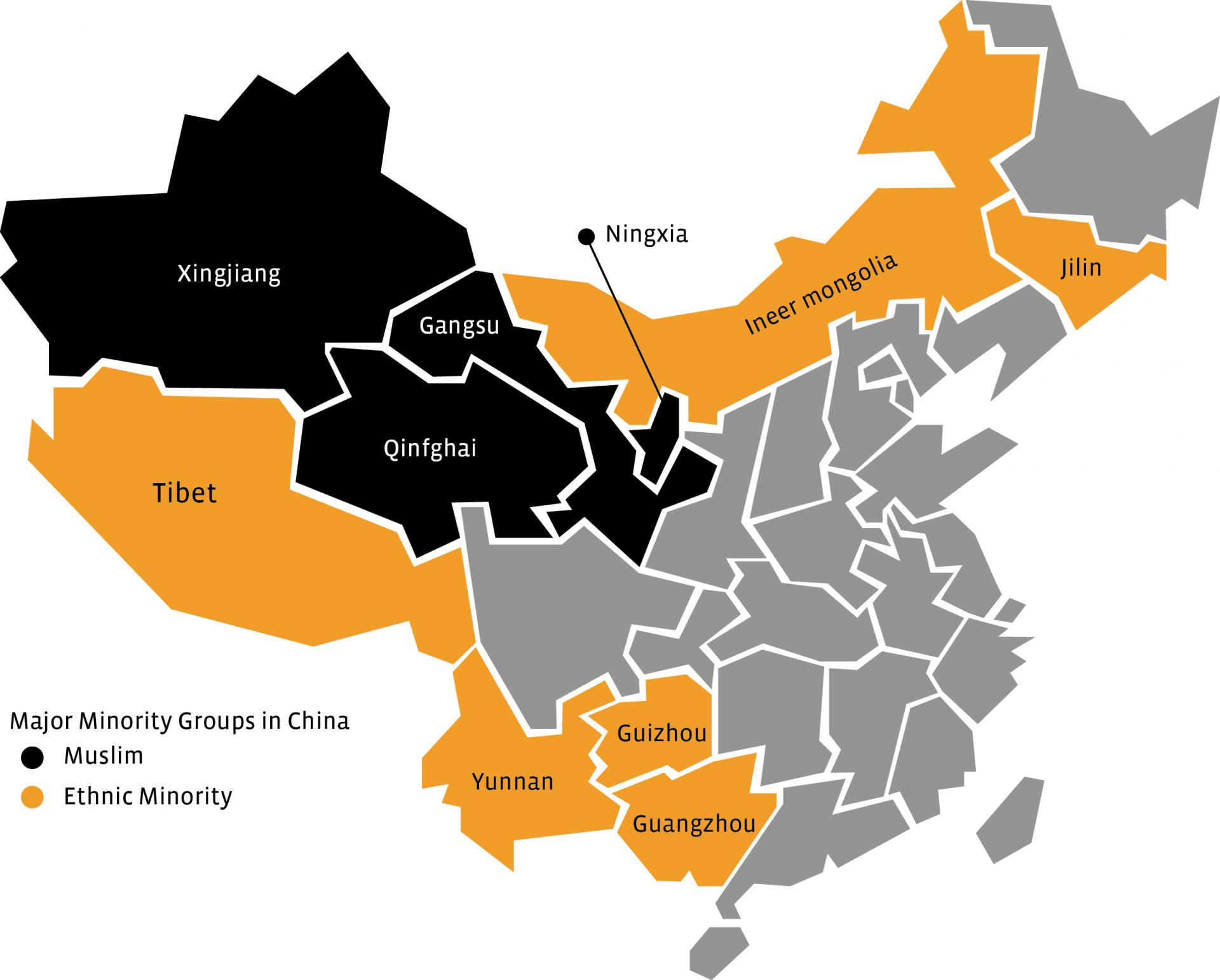

The majority of mainland China’s population is Han Chinese (91.5%), whereas the other 8.5% consists of 55 different officially recognized ethnic minority groups primarily located in the Southern, Western, and Northern regions of China (e.g. Guangxi, Tibet, inner Mongolia). These minority groups are continuously increasing and seem to be growing approximately seven times faster than the majority of Han Chinese. The Southwestern region of China consists of the most ethnically diverse provinces, where 26 of the 55 ethnic minority groups can be found. More than 38.07% of the population of Yunnan consists of ethnic minority groups such as the Miao, Yao, Mongol, Yi, and others. Guizhou also has one of the highest numbers of ethnic minority groups, as 37% of the population are members of such minorities. Shown below is a list of the top 10 largest ethnic groups and their growth rate in China:

Table 2 Ethnic Minority Population & Population Growth Rate in China

Ethnic minority groups also exist in the Northern and Eastern regions of China, such as the province of Jilin, which is home to many of China’s Korean minorities – the Chaoxian minority or otherwise known as the Josenjok. Apart from these several groups mentioned above, there are also numerous ethnic groups (about 730,000 people) that are considered “undistinguished” or not officially recognized by the Chinese government – a majority of them reside in Guizhou Province (e.g. Ayi, Bajia, Deng, Khmu, Sherpas, etc). With such a variety of ethnic minorities, each possessing its own set of unique social and cultural traditions, it is no surprise how diverse the Chinese market is.

Figure 1 Ethnic Minority Concentrations in China

This diversity of ethnic groups within China has begun to steer China in the direction of the globally emerging trend in ethnic minority consumer research, allowing brands in China to gain a better outlook on what appeals to such segments of the Chinese consumer market. One major area calling on such research revolves around the beauty and cosmetics industry. Understanding the Muslim minority group, especially Muslim women, has become a strong focal point for the product development and marketing of many brands who are looking for new opportunities within this competitive industry.

The main concern of many Muslim consumers pertains to the manufacturing of these cosmetic products. Pork extracts and alcohol are common ingredients that interfere with the Muslim lifestyle of Halal – loyalty to the conditions of Islamic law.

The Halal cosmetics business is gradually gaining prestige and is estimated to be worth US$13 billion globally (Hala Focus, 2010). Large companies such as The Body Shop and L’Oreal have produced particular cosmetic and beauty products that are Halal certified. Distinctive campaigns have been used to promote such aspects of brand and product credibility in order to attract this particular segment of minority consumers. Some experts have termed the soon-to-be trend in branding, “Islamic marketing”.

Over 20 million – 1% to 2% of China’s population is Muslim. Compared to the 60.4% Muslim population in Malaysia – about 11 million, the proportion may seem fairly small, however great opportunity does exist among Chinese Muslim consumers.

The three main Muslim communities are the Hui, Uygurs, and Kazakhs, who are predominantly located in the North-Western provinces of Xinjiang, Ningxia, Qinghai, and Gansu; although a considerable amount of Muslims also live in the cities of Beijing, Tianjin, and Shanghai. This serves as an attractive market for Halal producers- especially in the domain of food, which has already penetrated the Chinese market. It seems that these food products are “small-scale entrepreneurs whose products have little value added and lack branding and technology to push their goods to international standards.” Little has yet been seen in cosmetics and beauty industries, but increased research in this field has sparked interest in capitalizing on the growing demands for Halal cosmetics in China.

For example, Beijing’s Bao Chun Herbal Biological Science & Technology Research Company has directed their attention on using only 100% natural ingredients in their products, from toothpaste to various creams, and to shampoos and shower gels, which many of China’s Muslim women population seem to accept. Another global brand that is receiving reaction from Muslim women in China is The Body Shop, which also advertises its natural and organic ingredients, but, ironically, does not specify if their products are Halal. Unfortunately, such products cannot be found in any current Chinese department store; however, they can be purchased online through shopping websites such as Tao Bao (China’s largest online shopping site). Due to the greater availability of Halal cosmetics in the neighboring areas of Hong Kong, Macau, and Taiwan, such products are still fairly attainable by consumers who live in mainland China. Will brands entering China be able to take full advantage of this arising opportunity? The starting points in understanding the needs and expectations of Muslim women can be to explore brands and their product messages in more mature markets with regards to Muslim beauty products such as U.S., UK, Indonesia, and India.

The development of cosmetic and skin care products for Muslim women has been considered as a testing ground for brands to appeal to the needs of other minority consumers in the future. More and more international brands have leaped at this chance to develop more innovative products that are suitable for ethnic minority groups.

Colgate-Palmolive Halal Certification

Colgate-Palmolive has recently obtained Halal certification in Malaysia for several toothpaste and mouthwash products which do not contain alcohol ingredients. After examining market demand for Muslim women self-care products, and conducting several in-depth interviews, Colgate decided to focus on manufacturing and improving product lines to attract the international Muslim minority group.

Unilever Sunsilk Brand for Muslim Women

Unilever’s recent introduction of its Sunsilk Clean & Fresh brand shampoo in the Indonesian market is a testament to the importance of understanding and catering to minority populations. Specifically directed towards Muslim women who wear headscarves, the campaign focused on providing “tailored solutions to local hair dramas.” Unilever’s multi-local strategy, emphasizing extensive research and development to customize globally marketed brands, involved interviews with Muslim women through focus groups and one-on-one sessions. This comprehensive approach aimed to identify perceptions of specific brands, exposure to mainstream media, and the emotional representations that resonated with the target audience. By creating a brand identity that portrayed harmony, warmth, and dynamic femininity, Unilever successfully established a unique niche in the Indonesian market for Muslim minorities. This example underscores the significance of thorough research and strategic brand development in effectively appealing to the emotional and psychological triggers of consumers within minority populations.

In-depth research on ethnic minority populations is crucial for understanding how to establish a product brand that resonates on a personal level with consumers. This research guides the creation of a favorable brand position in the minds of consumers and within the competitive marketplace. Given the immense size and competitiveness of China’s cosmetic market, staying abreast of emerging research trends becomes vital for brands looking to seize new opportunities and establish a robust brand presence ahead of the competition. This is particularly relevant in ethnically diverse countries like China, where creating brands that connect with distinct groups is key to successful consumer interaction. As attention on ethnic minority consumer research in China increases, understanding the unique preferences and desires of different ethnic groups becomes essential. Whether examining Muslim consumer preferences globally or localizing products for the Chinese market, brands can gain insights into crafting key brand messages that effectively communicate with and resonate with various target groups within the Chinese consumer landscape.

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.